Touch the Sky

This is about a guy from JAPAN, who finished a MBA degree in the U.S. and moved to New York City for a new job....Just trying to experience things that nobody can....no regularly update is promised...but promise to do my best with hope that I can share my extraordinary life with my friends.

Saturday, January 31, 2009

Thursday, January 29, 2009

Wednesday, January 28, 2009

Tuesday, January 27, 2009

ウォールストリート日記

今日は以前から読まして頂いているかたのBLOGをご紹介したいと思います。

ウォールストリート日記

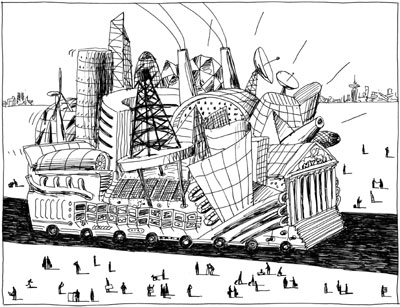

2008年は、米国債と金を除く世界中の主要な市場が大暴落する、歴史的な年になりました。世界の金融界をリードしていた“はず”のウォールストリートを 震源地とした未曾有の金融危機は、世界中の投資家の自信を喪失させ、また金融本来の機能である「資金の融通」も滞って、実体経済も急激に冷え込んでしまい ました。

2009年は、そんな混乱の中で始まりましたが、NY Timesの年初(1月3日)のOP-ED、「The End of the Financial World as We Know It」の中で寄稿者は、「世界は、アメリカ金融界への自信を“ほぼ”喪失してしまったようだが、まだ修正のチャンスはある。では“何が”修正されるべきだろうか」という問いかけをしていました。

このOP-EDに寄稿したのは、後にLTCMを立ち上げたJohn Meriwether氏が率いた元ボンド王国Salomon Brothers(現Citigroup)の内情を描いた名著「Liar's Poker」 の著者であるMichael Lewis氏と、昨年Lehman Brothersの問題を公に指摘して物議をかもしたヘッジファンド、Greenlight CapitalのマネージャーであるDavid Einhorn氏です。(後者の話はこのブログでも取り上げたと思います。)

しかし 実際は、寄稿者達も大いに認める通り、ウォールストリートの現場にいた人達や、業界を外から眺めていた人の中には、問題に早々に気づいていた人も少なくな かったように思います。(ここではウォールストリートを、本来の意味である「証券業界(証券会社+証券会社を傘下に持つ銀行」という定義で使います。)

(1月19日分を一部抜粋)

毎回興味をそそられる内容を掲載しているので思わず読み込んでしまいます。

どこかのわけの分からないブログとは大違いです。

いやー恥ずかしい。

Monday, January 26, 2009

Sunday, January 25, 2009

Friday, January 23, 2009

Good things come in threes

People say good things come in threes but for this bastard they come in tens.

John Thain's Top Ten Greatest Moments

If there's one corporate honcho who's emerging as the poster boy for all the varied Wall Street sins that the financial crisis has exposed -- not just greed, but callousness, obliviousness and general incompetence -- its Merrill Lynch's former CEO John Thain.

Over the last few days, the revelations about Thain's mismanagement of Merrill have been coming thick and fast -- culminating with his ouster yesterday as an executive at Bank of America, which bought Merrill at the height of the financial crisis last September.

Thain, a top John McCain backer who was tipped as a candidate for a White House post had the Arizona senator won the presidency -- has amassed quite a record in his short time at Merrill. Lavish personal spending, absentee leadership, bonuses for billions in losses -- it's almost been too much to keep track of.

So we've created a handy rundown of Thain's top 10 greatest moments over the last turbulent year. (You might also want to check out our Merrill Lynch timeline to brush up on how Thain's missteps fit in with the larger story of his firm's collapse.)

In rough chronological order, here are John Thain's top 10 greatest moments:

1. The Great Redecoration

Thain pays $1.2 million last year -- well after Merrill's huge losses on mortgage assets are known -- to refurbish his office suite. That includes $800,000 to interior designer Michael S. Smith, who's also redecorating the White House for the Obama family. (More Smith clients: Steven Spielberg, Michelle Pfieffer, and Cindy Crawford.)

Other expenses from the big redecorating project, all signed off on by Thain personally:

Area Rug: $87,784

Mahogany Pedestal Table: $25,713

19th Century Credenza: $68,179

Pendant Light Furniture: $19,751

4 Pairs of Curtains: $28,091

Pair of Guest Chairs: $87,784

George IV Chair: $18,468

6 Wall Sconces: $2,741

Parchment Waste Can: $1,405

Roman Shade Fabric: $10,967

Roman Shades: $7,315

Coffee Table: $5,852

Commode on Legs: $35,115

At this time, reports CNBC's Charlie Gasparino on The Daily Beast, Thain is "preaching the virtues of cost control, telling employees to reduce expenses including car services, entertainment and travel".

2. The Unfortunate Chair Incident

During a summer 2008 meeting with his top financial officer, Thain, angry about Merrill's huge mortgage-asset-related losses, hurls a chair against the wall, shattering a nearby glass panel.

3. Just Can't Quit Those Mortgage Assets

Even after Thain has been forced to beg Bank of America to save his desperate firm, his traders, thinking the market has "bottomed out", keep trading risky mortgage securities. Those, of course, are the very assets that had helped bring on the massive losses, mostly incurred before Thain's tenure, that made the Bank of America deal necessary.

4. The Bonus Fiasco

In October, Thain suggests he should receive a $30-$40 million bonus. By December, he compromises: $10 million. After a blizzard of public criticism, including from New York Attorney General Andrew Cuomo and Senate Majority Leader Harry Reid, he drops his request for any bonus. Later, he denies having asked for one at all.

5. The In-Retrosepct-Ill-Advised Ski Trip

In mid December, Bank of America CEO Kenneth Lewis learns that Merrill's fourth quarter losses will be much larger than expected. Lewis gets the bad news not from Thain himself, but from the transition team handling the merger -- perhaps because, after the losses surface, Thain takes off for his ski house in Vail. (A "person familiar with the matter" tells the Journal, hilariously, that Thain was "working and available" while in Vail.)

6. The Failure To Impress The New Boss

Asked by Lewis about the new losses, which will officially come to $15.3 billion, Thain "didn't really have a good grasp of what was going on,", one source tells the Wall Street Journal. Ultimately, the federal government will in January give Bank of American $20 billion -- on top of the bailout funds it had already gotten -- to help it absorb the Merrill losses.

7. The Troubling Lack Of Candor

Under Thain, Merrill appears not have been as forthcoming as it might have been with its new owner about the state of its books. A Bank of America spokesman tells the Journal today: "Their fourth quarter was way beyond anything they said would happen." Even worse, Thain may also have been less than straight with Merrill itself. He doesn't fully inform his own board that, thanks to Merrill's losses, the federal government might need to step in to ensure the B of A deal goes through, according to complaints from board members.

8. The Other Bonus Fiasco

Merrill, with Thain still in charge, accelerates its yearly bonus payments, doling out an estimated $3-4 billion in bonuses before January 1, 2009, when Bank of America will take control. Some at B of A believe the expedited schedule is designed to avoid giving B of A a chance to cut those payments. New York AG Cuomo is now reportedly investigating.

9. The In-Retrospect-Ill-Advised Planned Trip to Davos

Thain plans a trip to Davos to attend the World Economic Forum next week -- even though Bank of America has discouraged the idea.

10. The Final Act

Thain pays $483,320 for 84,600 shares of Bank of America. The following day, he's fired.

Monday, January 19, 2009

Bergdorf Goodman

今年はパソコンの環境も整ったのでこのブログも大幅構造改革を計画しております。

まぁー計画は2年前ぐらいから始まっておりましたが。

Bud light Lime.

味は日本人にも大人気のコロナにライムが最初から入っている感じです。

ではでは。

Sunday, January 18, 2009

HUDSON RIVER PLANE CRASH hitting the water(CLEAR TOURIST FOOTAGE FROM BANK)

OMG. I am so glad that there's no causality..

I just happened to meet two of the passengers a day before and also saw them at a restaurant called Menchanko Tei just before they took the plane..

Friday, January 16, 2009

災難

A US Airways jetliner with 155 people aboard lost power in both engines, possibly from striking birds, after taking off from La Guardia Airport on Thursday afternoon. The pilot ditched in the icy Hudson River and all on board were rescued by a flotilla of converging ferries and emergency boats, the authorities said.

-New York Times

NEWYORKは2009年も大変そうですね。。。

.jpg)